MERGER CONTROL

Close monitoring of mergers and acquisitions

Merger control is vital for the structure of the French economy, preventing mergers and acquisitions from creating or strengthening market positions that could have a negative impact on the market, particularly in terms of higher prices for consumers. A look back at an intense year throughout France and in every economic sector.

An activity that continues to grow

While the value of merger and acquisition deals worldwide fell by more than 20% in 2023 compared with 2022, the number of transactions examined by the Autorité continued to rise, from 257 in 2022 to 266 in 2023 – i.e. one case per working day. In 2023, the cases examined included three European-scale transactions referred to the Autorité by the European Commission, which considered that the Autorité was best placed to examine the cases, given its experience and the fact that the effects of the transactions were mainly felt on French territory.

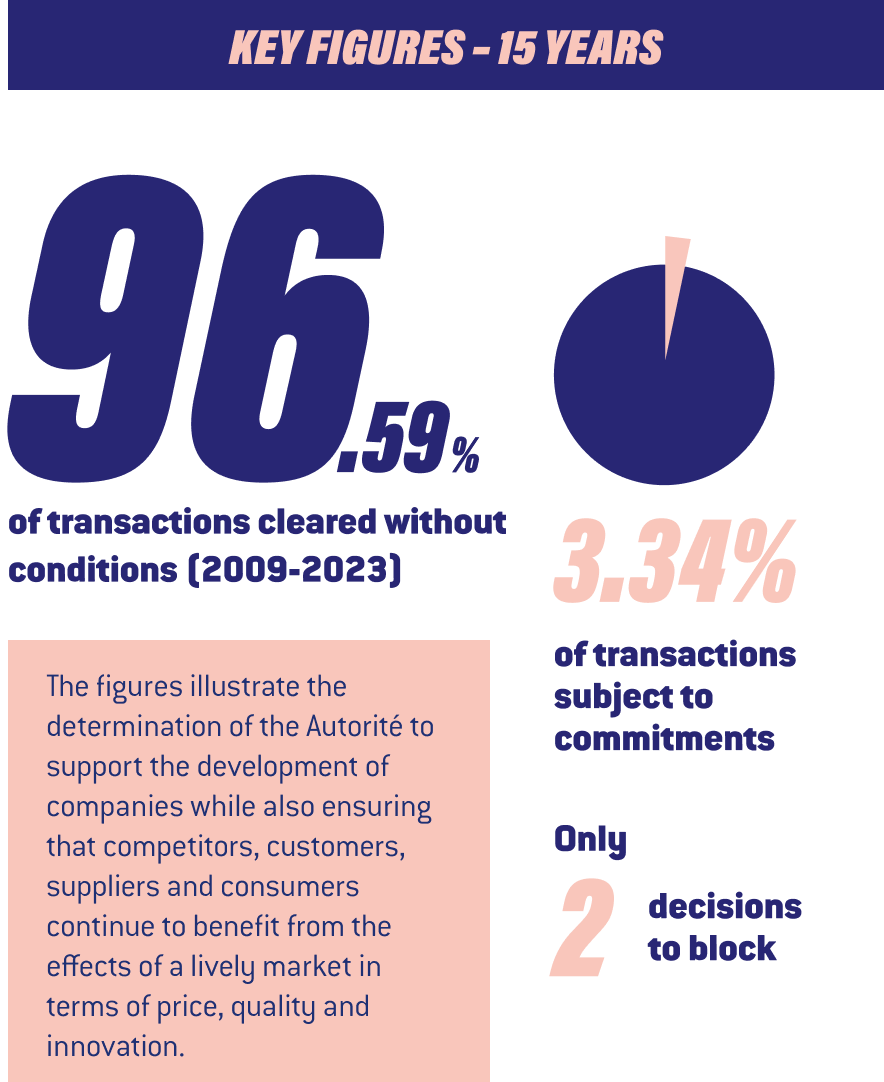

While the vast majority of the transactions examined by the Autorité do not pose any particular difficulties, some require specific conditions (remedies) to be met, as was the case for four transactions in 2023. The remedies are the result of in-depth collaboration between the companies involved in the transaction and the Autorité. This dialogue leads to faster results and, in some cases, to innovative commitments.

266

MERGERS AND ACQUISITIONS EXAMINED IN 2023.

Overview of remedies in 2023

General merchandise and decoration: takeover of Bricolex stores by Gifi

The Autorité cleared, subject to conditions, the acquisition by the Gifi group, which operates in the distribution of general merchandise and decoration products, of Le Chamois, owner of Bricolex stores, which specialise in the sale of DIY products. As a result of the transaction, 21 Bricolex outlets became Gifi outlets, including eight in inner Paris and 13 in the Paris suburbs.

Recognising that the transaction was likely to harm competition in certain areas of Paris, the Gifi group committed to divest five Bricolex stores in the areas concerned.

Decision 23-DCC-57 of 21 March 2023

Camping: acquisition of Vacanceselect by the ECG group

In the outdoor accommodation sector, the Autorité cleared the acquisition of the Vacanceselect group by the ECG group, subject to conditions. The companies rent out camping pitches to consumers, either on their own campsites (i.e. directly and entirely owned by the groups) or on sites owned by third-party campsites, which they operate under tour operator contracts.

During its investigation, the Autorité identified risks of harm to competition on the markets for the operation of campsites at the local level. To prevent these risks, ECG committed to divest a campsite in the Les Prés du Verdon area (Alpes-de-Haute-Provence) and to enter into a contract with a third-party campsite to operate 27 highend serviced pitches in the La Croix du Vieux Pont area (Aisne).

Decision 23-DCC-32 of 14 February 2023

Motorway catering: acquisition of Sirestco by the Areas group

In the motorway catering sector, the Autorité imposed conditions on the acquisition of the Sirestco group by the Areas group, identifying risks of harm to competition in several markets for the provision of services. On the A5 and A19 motorways, the Areas group would have had a market share in excess of 50% following the merger, with a risk of price rises and a reduction in the quality of the offer for consumers.

To resolve these risks, the Areas group made commitments involving, on the one hand, divesting the sub-concession contract for the catering and food retail activities of the specialist shop at the Troyes-Fresnoy service station on the A5 motorway, and, on the other, transferring the lease management contract for the operation of the “Casino Everyday” shop at the Loiret service station and entering into a third-party operating contract for catering activities at the same station on the A19 motorway.

Decision 23-DCC-151 of 25 July 2023

Takeover of ZEturf by La Française des Jeux

The Autorité also made the takeover of ZEturf by La Française des Jeux (FDJ) subject to commitments, considering that, as a result of its monopoly on the distribution of lottery games (online and at points of sale) and sports betting at points of sale, the new entity could have been tempted to use its exclusive right as a lever to restrict competition in the markets open to competition (online horse race and sports betting).

In addition, as regards horse race betting in particular, the new entity would have been able to prevent or make it more difficult for competitors to access the common betting pools managed by the new entity or to remove horse race bets collected by the new entity from these pools.

FDJ committed to not using its monopoly gaming activities to develop competitive games and to clearly separating its monopoly gaming activities from its competitive gaming activities, in particular:

- by setting up separate websites or applications for each type of activity, with no common home page and no gateway between them;

- by creating or maintaining a player account for each activity, with no possibility of a gateway between accounts;

- by refraining from recreating a customer database to promote its competitive gaming activities, which would include data relating to players of monopoly games.

FDJ also committed to not promoting any of its competitive games in its network’s points of sale or to online lottery players, and to operating separate social network accounts for each type of activity.

In addition to these measures, its sales teams will receive training on how to respect the commitments. Furthermore, FDJ will organise its competitive gaming activities within one or more dedicated subsidiaries.

Decision 23-DCC-191 of 15 September 2023

Acquisition of OCS and Orange Studio by Canal Plus Group

As part of its analysis of the transaction, the Autorité conducted a wide-ranging market consultation with operators in the film, television and video-ondemand sectors. It also worked closely with the French audiovisual and digital communication regulator (Autorité de régulation de la communication audiovisuelle et numérique – ARCOM) and the French Directorate General for Media and Cultural Industries.

The transaction could have had a significant impact on the diversity of French cinema by creating a monopsony (single buyer) situation in certain markets. After its examination, the Autorité cleared the acquisition in Phase 1 subject to conditions. To address the risks of harm to competition identified, Canal Plus Group entered into commitments aimed, in particular, at preserving the diversity of the French film offering by maintaining an OCS/Ciné+ acquisition team, separate from that of Canal+, for films distributed in the “first window” of the release schedule.

To further guarantee the diversity of French cinema, Canal Plus Group also committed to make, on behalf of the Ciné+/OCS team, pre-purchase proposals for a minimum of 25 French film projects over five years, including at least four French film projects per year (of which one per year with a budget of less than €4 million) for films rejected by the Canal+ acquisition team for first-pay-window broadcast.

Decision 24-DCC-04 of 12 January 2024

Takeover of Casino stores by Intermarché cleared subject to conditions

On 13 July 2023, Intermarché notified the Autorité of its plan to acquire 61 stores under the Casino group brand.

After careful examination of the transaction, the Autorité cleared the acquisition of the target stores, subject to commitments presented by Intermarché, including the divestiture of three stores.

Decision 24-DCC-02 of 11 January 2024